home buying

preparation

Good credit is vital for buying a home. It can help you get a low-rate mortgage, more buying power, and savings on other expenses such as insurance and property taxes. Insurance companies offer discounts to homeowners with good credit. Maintaining good credit improves your chances of getting a mortgage with favorable terms and saves you money when buying a home.

financial

literacy

Financial literacy is vital as it offers knowledge to make informed decisions on managing finances, investments, and planning for the future, enabling wise investment decisions, and planning for financial independence.

collections

Metro 2 compliance removes collections from credit reports. The process involves reviewing and disputing collections and charge offs. This empowers consumers to control and ensure credit report accuracy and legitimacy.

car buying

preparation

Good credit = better rates, lower payments & more options for buying a car. Bad credit = difficulty getting a loan & higher interest rates. Good credit saves money & makes buying a car easy.

credit

education

We educate on good credit and management, covering credit scores, reports, cards, debt, and identity theft. My goal is to provide knowledge and tools for informed decision-making using practical examples to instill confidence and responsibility for a healthy financial future.

student loans

Removing negative student loan payments or derogatory marks from your credit report can be a challenging process, but it is possible. Remember that it takes time and effort to improve your credit, so be patient but we will be persistent in challenging these items.

bankruptcies

Bankruptcies are one of the hardest items to remove. We will use Metro 2 compliance to remove the inaccurate information on your credit profile.

repossessions

& foreclosures

We help improve credit scores by removing mistakes and enabling access to credit services for those who have had repossession or foreclosure.

Debt help

Helping to Reduce Your Monthly Debt Payment by up to 50%!

✔ Secure a Single Affordable Monthly Payment

clients who trust us

“The lawyers at this firm are very professional and talented. They always impress me with their knowledge and dedication.”

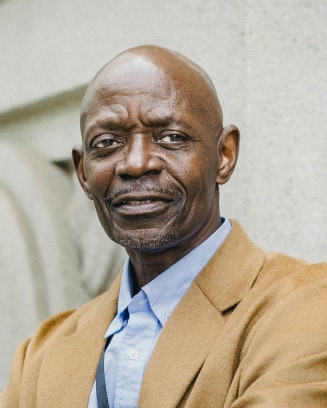

mark Dixon

Truva Properties LLC, Founder

Phillis Reed

Gloritech Inc., VP Operations

“Jenna was so compassionate and really seemed to care about my case! She was so nice to work with and helped me get the results I wanted!”

sara Barker

Personal Injury Client

talk to us

We offer personalized credit repair consultations that help identify negative items and create a plan to improve your score. Our team also offers guidance on maintaining good credit habits. Schedule a consultation today to take control of your credit and improve your financial situation.

latest posts

As a credit repair expert, you know that the accuracy and reliability of consumer payment information are crucial for lenders, creditors, and …